Social Security Explained: Will It Run Out and How Much Will You Get?

The short answer is no. There will always be a retirement benefit.

A Brief History of Social Security

Social Security, also known as OASDI (Old-Age, Survivors, and Disability Insurance), was signed into law by President Roosevelt in 1935. The goal was to create a social welfare program to help retired workers aged 65 or older.

"We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life, but we have tried to frame a law which will give some measure of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age."

- President Roosevelt upon signing Social Security Act

The baby-boomer generation contributed significantly to Social Security, creating a growing surplus. As baby boomers started retiring, the growth of this surplus slowed down over time.

The surplus grew to $2.9 trillion by 2021 but has been declining since. In 2023, $41 billion was drawn from the surplus. Projections suggest that the entire surplus could be depleted by 2035.

How much will I be paid by Social Security?

A Social Security check consists of two components:

- 80% from current OASDI taxes from payroll

- 20% from the surplus

Two factors determine the amount you receive:

- Money contributed: Contributions are capped at a salary of $168,600 or more.

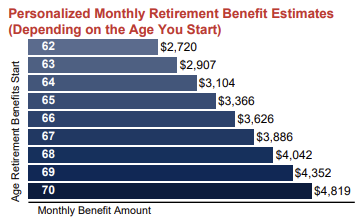

- Year of retirement: You can retire as early as 62 and as late as 70 for full benefits.

For example, if you paid the maximum contribution and retired at 70, you would be eligible to receive a monthly benefit of $4,873 in 2024.

Future of Social Security Benefits

Social Security won't run out as long as there are people in the workforce as they contribute 80% of the benefit. However, the overall amount may be less for older generations unless new legislation addresses the decreasing surplus.

Check Your Social Security Benefits

You can check your current eligibility and monthly payout at SSA.gov. When estimating your benefits, consider using 80% of the total value for a more conservative estimate.

SSA.gov Report Preview

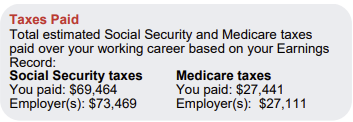

Here is a glimpse of the report that SSA.gov provided me for my contributions into Social Security and Medicare over the last 12 years.

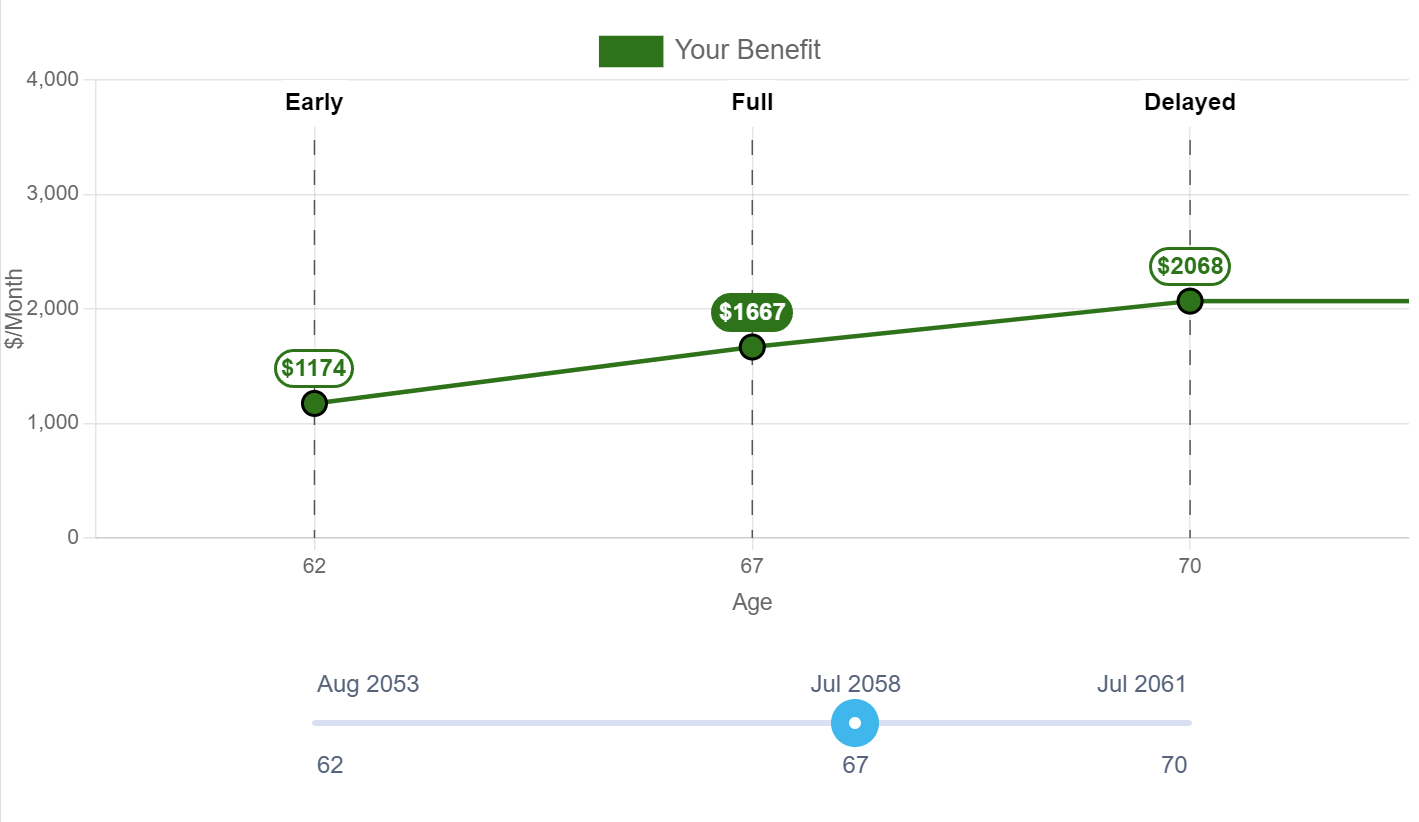

If I were to continue to earn more than 160,200 per year, the numbers below would be my monthly benefit based on retirement age. I would realistically estimate on 80% of the presented values as I am retiring after 2035 when the surplus is projected to run out.

One fun number to find for yourself is the minimum benefit you qualify for if you stop contributing taxes. In my situation, this ranges between $1174 and $2068.

Key Takeaways

- Social Security benefits are funded by payroll taxes and a surplus.

- The surplus is projected to be depleted by 2035, potentially affecting benefit amounts.

- Check your eligibility and benefits on the official Social Security website.

Social Security remains a vital part of retirement planning. Staying informed about changes and projections can help you plan better for the future.

References

Comments ()